Two years after the start of Russia's war of aggression against Ukraine in spring 2022, the global energy situation remains tense. Although the additional pressure on energy markets from the COVID-19 pandemic has eased and fossil fuel prices have fallen from their 2022 highs, energy markets remain unstable, as does the geopolitical and global economic situation. In addition to the ongoing war in Ukraine, the risk of a protracted conflict in the Middle East has increased since the end of last year. Should the armed conflict between Israel and Palestine spill over into neighbouring countries, there is a risk that oil production could be disrupted or key sea routes blocked, causing further significant disruption to energy markets. The International Energy Agency's (IEA) latest World Energy Outlook (WEO) shows that while demand for gas, coal and oil remains high, it will peak by 2030. In the years thereafter, demand for oil and gas is expected to remain relatively constant, declining only slightly overall, but increasingly replaced by renewables.

Green energy expansion remains strong

As in last year's report, the WEO 2023 highlights that the importance of renewable energy sources in energy markets is already growing significantly. For example, investment in the sector has increased by 40% since 2020. At around €1.7 billion, global energy investment in renewables in 2023 was significantly higher than the €1 billion invested in fossil fuels. However, not all green technologies are performing equally well and some supply chains, such as wind power, are under pressure. Nevertheless, the overall trend is clear: more than 500 gigawatts of additional renewable generating capacity was added last year - a new record. Production capacity for key components of a sustainable energy system, such as photovoltaic modules and electric batteries is expanding rapidly. While only one in 25 cars sold globally in 2020 was an electric car, the share had risen to a fifth by 2023.

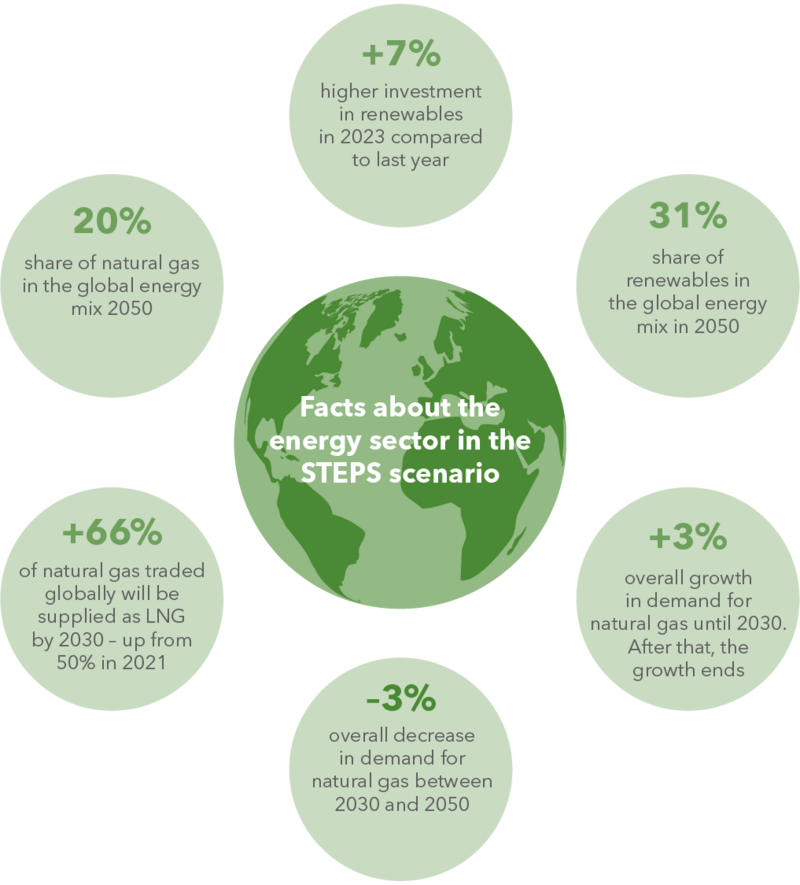

In the STEPS scenario, which is based on the current policy framework (see box below), the IEA projects a share of renewables of around 120 exajoules (EJ) in 2023, with total energy demand at around 670 EJ. The WEO 2023 also forecasts an increase in total energy demand of almost 15% from today to a total of 725 EJ by 2050. This is due to growing demand in emerging and developing countries, which clearly outweighs the simultaneous decline in demand in advanced economies.

Fossil fuel demand peaks as early as 2030

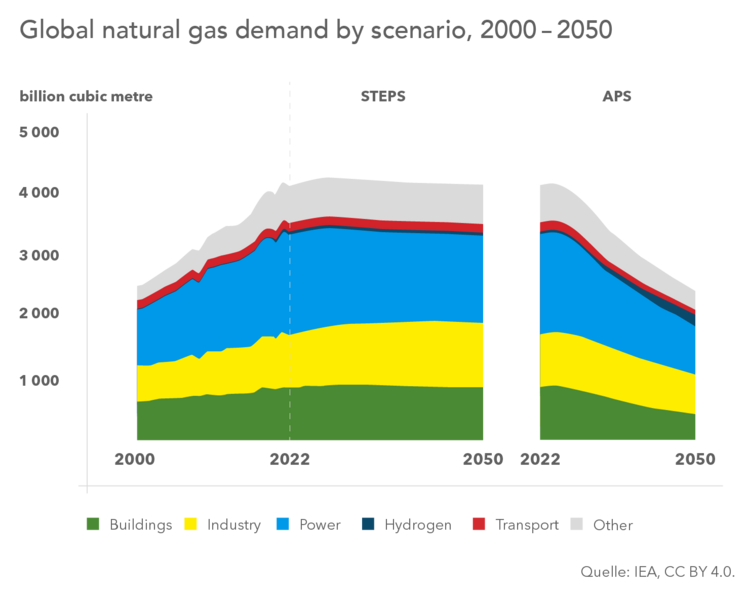

Similar to last year's IEA report, the STEPS scenario predicts a decline in demand for all fossil fuels. What is new, however, is that for the first time demand growth for all three fossil fuels (gas, coal and oil) is projected to end by 2030 at the latest. While demand for coal will peak in the mid-2020s, oil and gas are expected to peak by the end of this decade. STEPS expects demand for both oil and gas to remain relatively constant in the following decades, but to decline slightly over the whole period. By 2050, demand for oil in the road transport, buildings and power sectors will decrease, while demand in the petrochemicals and aviation sectors will increase. The oil price is estimated to be relatively stable between 2030 and 2050 in the STEPS scenario, as declining oil demand from the late 2020s onwards is offset by declining supply from existing oil fields. In terms of changes in gas demand by sector, the industrial sector is expected to increase and the power sector to decrease. Like oil prices, natural gas prices are expected to remain constant between 2030 and 2050 according to STEPS. Although the loss of Russian gas supplies has had a negative impact on supply, additional LNG export capacity in particular will help to ease the situation on the gas markets from 2025 onwards.

Natural gas market: slow growth followed by slow decline

According to the STEPS scenario, natural gas demand growth between 2022 and 2030 will be significantly lower than between 2010 and 2021, when the growth rate was 2.2%. As a result, demand peaks at around 4300 billion m3 by 2030 and then slowly declines by 130 billion m3 to around 4170 billion m3 by 2050. According to the APS scenario (see box below), demand peaks even earlier and is already well below the 2022 level by 2030. In this scenario, natural gas consumption would even fall to around 2400 billion m3 by 2050.

In all scenarios, natural gas demand falls in advanced economies. However, in emerging and developing countries STEPS projects that demand will increase until 2050. In addition, the Middle East grows in importance and becomes the main source of additional global natural gas supply. In the STEPS scenario, its share of total natural gas production rises from 15% in 2022 to 25% in 2050, meaning that global natural gas trade would increase by almost 15% between 2022 and 2030. Although this is only half the growth rate of the previous decade, it is more than four times the future growth rate of natural gas demand to 2030. By 2030, two-thirds of the world’s traded natural gas would be delivered in the form of LNG. In 2021, the share was around 50%. While the US consolidates its position as the world's largest gas exporter in all scenarios up to 2030, Russia does not reach its total gas export volumes of before 2022 in any of the scenarios.

Green hydrogen continues to gain momentum

Among the green gases, hydrogen will play the most important role in the future gas market. According to STEPS, seven million tonnes of low-emission hydrogen will be produced in 2030. Most of this will replace existing supplies of non-green hydrogen for ammonia plants and refineries. In the APS and NZE scenarios (see box below), both of which assume much stronger policy measures to stimulate hydrogen demand than STEPS, the figures for hydrogen are much higher. In the APS, the demand for low-emission hydrogen reaches 25 million tonnes in 2030; in the NZE scenario, the figure is 69 million tonnes.

While the near-term outlook is somewhat dampened by cost inflation, uncertainty about policy measures and bottlenecks in the supply chain, the overall trend is positive. Investment in hydrogen projects totalled one billion euros in 2022. A new record was set in May 2023 when the world's largest electrolysis plant was put in operation - a 260-megawatt plant in China that will replace hydrogen from natural gas in an oil refinery.

Conclusion

The WEO 2023 shows that the immediate pressures on the energy sector from the global energy crisis and high fossil fuel prices have eased. However, energy markets remain volatile due to ongoing geopolitical and global economic tensions. Even if the energy crisis has strengthened fossil fuels in the short term, it will significantly accelerate the transition to renewables in a few years’ time. The trend of the energy crisis accelerating the transformation of the global energy system towards more renewables is therefore continuing.

Natural gas is expected to continue to grow in importance over the next few years. However, it is also clear that demand for natural gas will peak by 2030 and then decline slightly in the following years. Nevertheless, natural gas will remain an important energy source, also as a bridge technology. In the future, hydrogen will play an increasingly important role in the global energy system.

This is the World Energy Outlook 2023

- The WEO is the flagship publication of the International Energy Agency (IEA) and provides a comprehensive overview of how the global energy system could develop in the coming decades.

- Since 1993, the IEA has been producing medium to long-term energy forecasts using the World Energy Model (WEM), a large-scale simulation model designed to simulate the functioning of energy markets.

- The current issue of the WEO and further information can be found online at: https://www.iea.org/reports/world-energy-outlook-2023

- Three scenarios for the energy sector of the future

- The "Stated Policies" scenario (STEPS) is based on the current political framework and measures that have already been implemented and announced.

- The "Announced Pledges" scenario (APS) assumes that all announced net zero emission commitments are met in full and on time.

- The "Net zero emissions by 2050" (NZE) scenario shows a pathway for the global energy sector to achieve net zero CO2 emissions by 2050.