In the course of the energy crisis, the German federal government took over all shares in SEFE Securing Energy for Europe (SEFE) in November last year. The missing Russian gas deliveries had to be procured anew on the European and global trading markets, at a multiple of the originally agreed delivery price. These replacements were partly substituted by pipeline gas from Norway and the Netherlands, but global LNG supplies already accounted for 10 per cent of SEFE's procurement portfolio in 2022 and are to be further expanded to 20 per cent in 2023.

By gaining access to capacities at European LNG terminals, such as in Dunkerque, France and the Hanseatic Terminal in Stade, as well as LNG deliveries via the Dutch energy trader Trafigura, SEFE was able to further diversify its portfolio and thus make an important contribution to security of supply in Germany and Europe.

Creation of large LNG capacities using the example of Germany

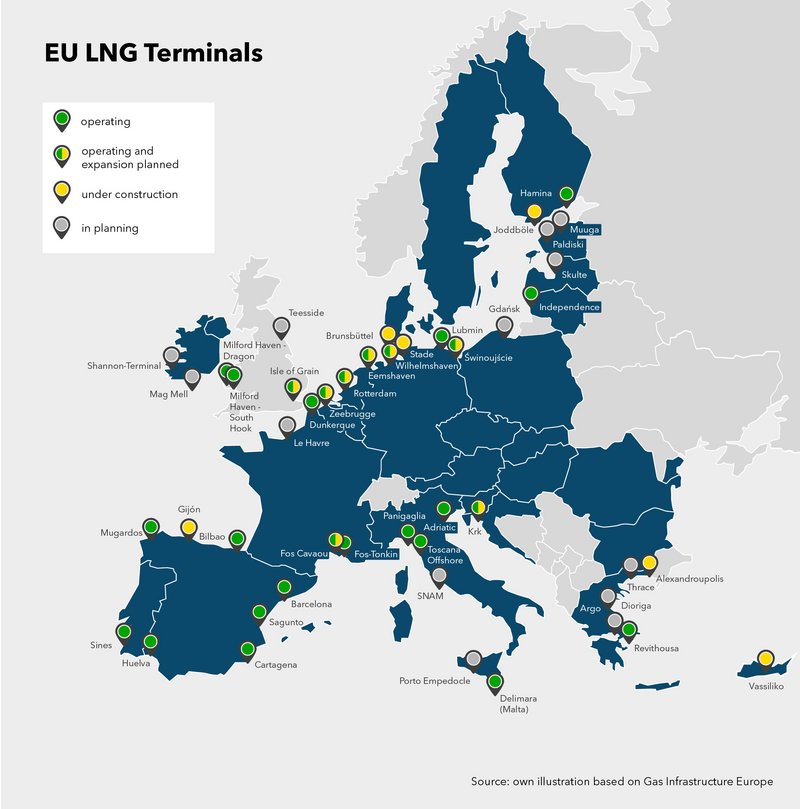

Against the backdrop of the lack of Russian gas supplies, several LNG terminals and the corresponding connection pipelines are currently being built in Germany at a rapid pace. Since mid-December, LNG tankers have been delivering the first liquefied natural gas via Wilhelmshaven. Further terminals are being built in Stade, Brunsbüttel and Lubmin. The Eastern European EU countries - historically particularly dependent on Russian gas supplies - are also expanding their LNG infrastructure. Lithuania, for example, has been importing large quantities of LNG in Klaipėda since 2014, supplying the entire Baltic region with natural gas. Poland is currently doubling the capacity of its LNG terminal in Świnoujście - also to supply the Czech Republic and Slovakia.

In the future, the share of LNG in European gas supply will continue to increase noticeably. According to the European Council, the EU is already the world's largest importer of LNG1. In 2022, the member states imported a total of around 123 billion cubic metres2 of LNG. By September alone, EU countries imported more LNG than in the previous record year of 2019, meaning the EU can currently meet around 40 per cent of its total gas demand with liquefied natural gas delivered by sea from producer countries. In the coming years, LNG could even account for the largest share of European gas supply. For Germany, experts expect LNG to cover about one third of the total annual gas demand in the future.

The importance of LNG continues to grow

While the EU imported around half of its gas from Russia in recent years, according to the EU Commission, this share decreased to less than 20 percent by the summer of 2022, and some countries have already completely substituted their imports from Russia. This means that alternative suppliers are gaining in importance. Norway, for example, is currently expanding its role as the most important supplier of pipeline gas to the EU. In 2022, for example, the share of Norwegian imports in Germany's gas supply rose to around 30 per cent. Algeria's role as a gas supplier is also growing in Europe. In addition to LNG, large quantities of pipeline gas are exported to Spain and Italy.

With the decline in natural gas imports via pipelines, LNG will become the central component of European gas supply in the future. This will make the EU countries' gas supply much more flexible, diversified and future-proof. After all, the members already receive LNG from a large number of countries around the world. The USA is currently by far the most important supplier and will most likely remain so, according to a study by the Institute of Energy Economics at the University of Cologne. The EU receives further quantities from Qatar and Nigeria, for example, as well as from Peru and Australia3.

LNG infrastructure important for shift to renewables

Although the current focus in the EU is on the further expansion of LNG import capacities, fossil gas in liquefied form remains a bridging technology towards a climate-neutral energy supply. The LNG infrastructure currently being built can also be used for "green" gases such as hydrogen. A hub for "green" gases is to be built at the terminal in Wilhelmshaven in the future. The connection pipeline there is already H2-ready. Thus, important framework conditions are currently being created so that the switch to low-CO2 energy sources can be accelerated in all sectors. With a view to the transformation of the energy industry, the SEFE Group sees itself as a pioneer of the energy transition and signed a memorandum of understanding with the Norwegian company Gen2 Energy for the supply of green hydrogen at the beginning of the year. A decisive and strategic step to ensure the future supply of customers in Germany and Europe not only with natural gas and LNG, but also with green hydrogen.

Both the existing and the currently emerging LNG infrastructure can provide Germany and the EU states with independence in the long term. Additional opportunities to diversify the energy supply also arise by strengthening the expansion of regionally produced biogas, building more power-to-gas plants, rapidly converting the supply infrastructure to hydrogen, and building more hydrogen terminals. Thus, through the current expansion of the LNG infrastructure, Germany is on the one hand closing the gap in natural gas supply and on the other hand taking an important step towards a sustainable and climate-neutral future in Europe.